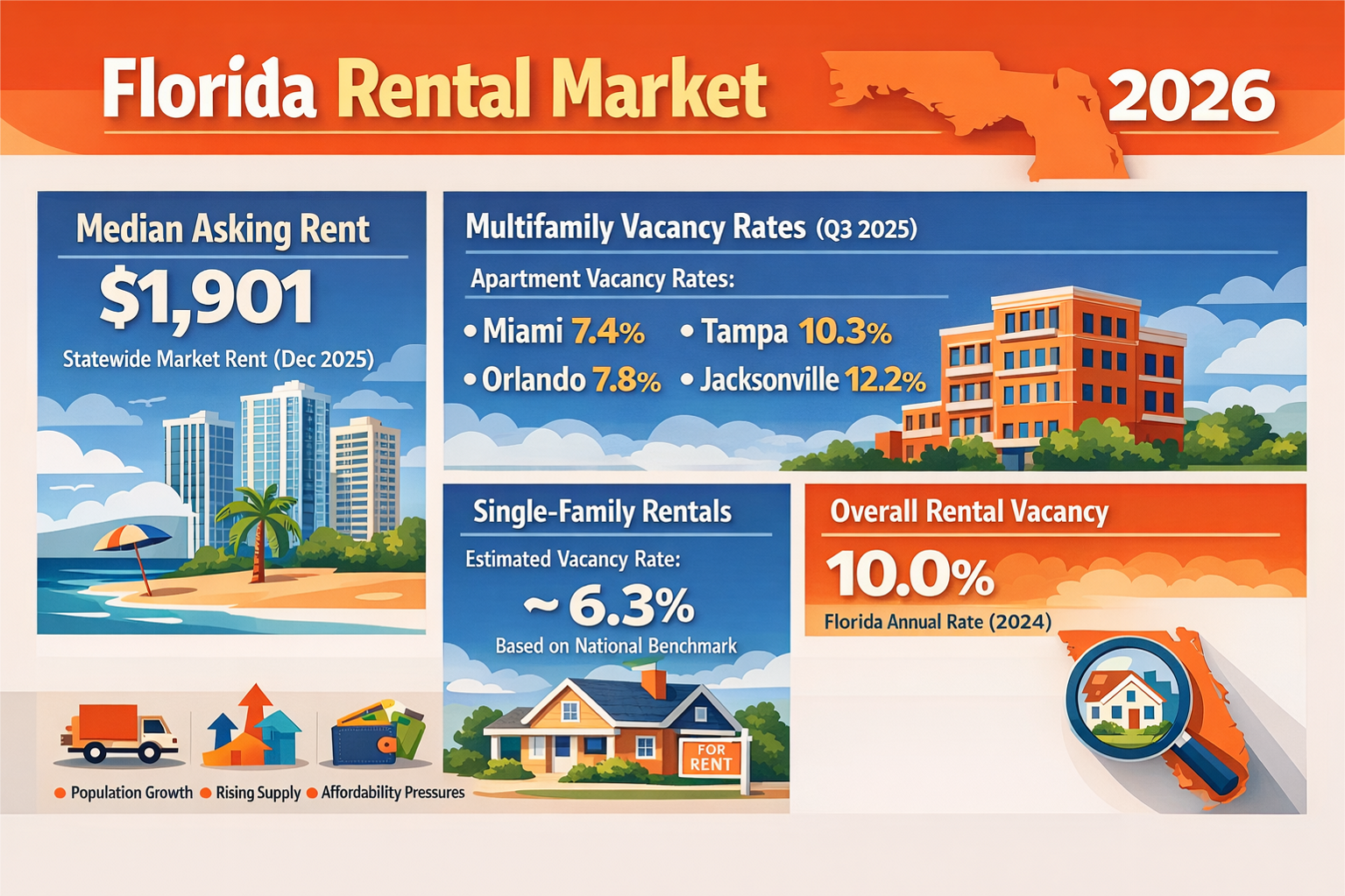

Florida Rental Market Report

Vacancy and Rent Trends as of December 2025

Statewide Snapshot – Cooling but Still Strong

- Median asking rent (all property types, FL statewide, May 2025): ≈ $2,090.

- Statewide vacancy rate: about 6.9%, up from 5.8% a year earlier, reflecting softer demand and a lot of new supply.

- What this means: the COVID-era boom is over; Florida is in a normalizing / slightly tenant-favored phase, but rents are still far above 2019 levels.

Metro-Level Highlights

Recent data show flat to slightly lower rents in many big counties compared with 2024:

- Miami-Dade: median rent around $3,000, down ~6% YoY; vacancy ~7.8%.

- Tampa (Hillsborough): median ≈ $2,100, down ~5% YoY; vacancy ~6.5%.

- Orlando (Orange): median ≈ $2,000, down ~4% YoY; vacancy ~6.2%; rents in Central FL are roughly 2% lower than a year ago.

- Jacksonville (Duval): rents roughly $1,750–1,960, essentially flat or up just 1–2% YoY, with relatively stable vacancy.

Despite softer pricing, competition for well-priced units is still intense in some markets. In Orlando during 2024 there were about 10 applicants per vacant unit, with occupancy around 94–95% and ~66% of renters renewing.

Supply & Construction

- Huge wave of new multifamily delivered in 2023–24; thousands more units were under construction as of late 2024 in Orlando and other metros.

- Starts slowed sharply in 2024, which should help vacancy peak and then ease by late 2025–26.

Result: Short-term pressure on rents and higher vacancy, especially in Class-A apartments, but a healthier balance long-term.

Tenant Financial Health

- Florida has one of the highest credit-card delinquency rates in the country (90-day+ delinquencies ≈ 11.7%), making it harder for renters to qualify under strict credit standards. The Listing Real Estate Management

- Inflation and insurance premiums are squeezing renters, pushing many to seek lower rents or concessions rather than pay top-of-market. The Listing Real Estate Management+1

Outlook for 2026

Most forecasts expect:

- Modest rent growth (roughly 0–3% annually) instead of the 10–20% spikes seen in 2021–22.

- Vacancy gradually drifting down as construction slows and population growth continues.

Practical Takeaways for Florida Landlords

- Price to the current market, not 2022.

- Think smaller increases ($25–$75/mo) and be willing to undercut the shiny new complex down the street if your vacancy is stretching.

- Shorten your “days on market.”

- With vacancy edging up statewide, aggressive top-end pricing can cost more in lost months than you gain in rent.

- Focus on retention.

- High renewal rates in places like Orlando show tenants prefer staying put; good maintenance and clear communication are now as important as price.

- Watch local micro-markets.

- Downtown Class-A apartments may need concessions; workforce single-family homes in good school zones can still command strong rents and multiple applications.