Unlock Cash Flow with Depreciation:

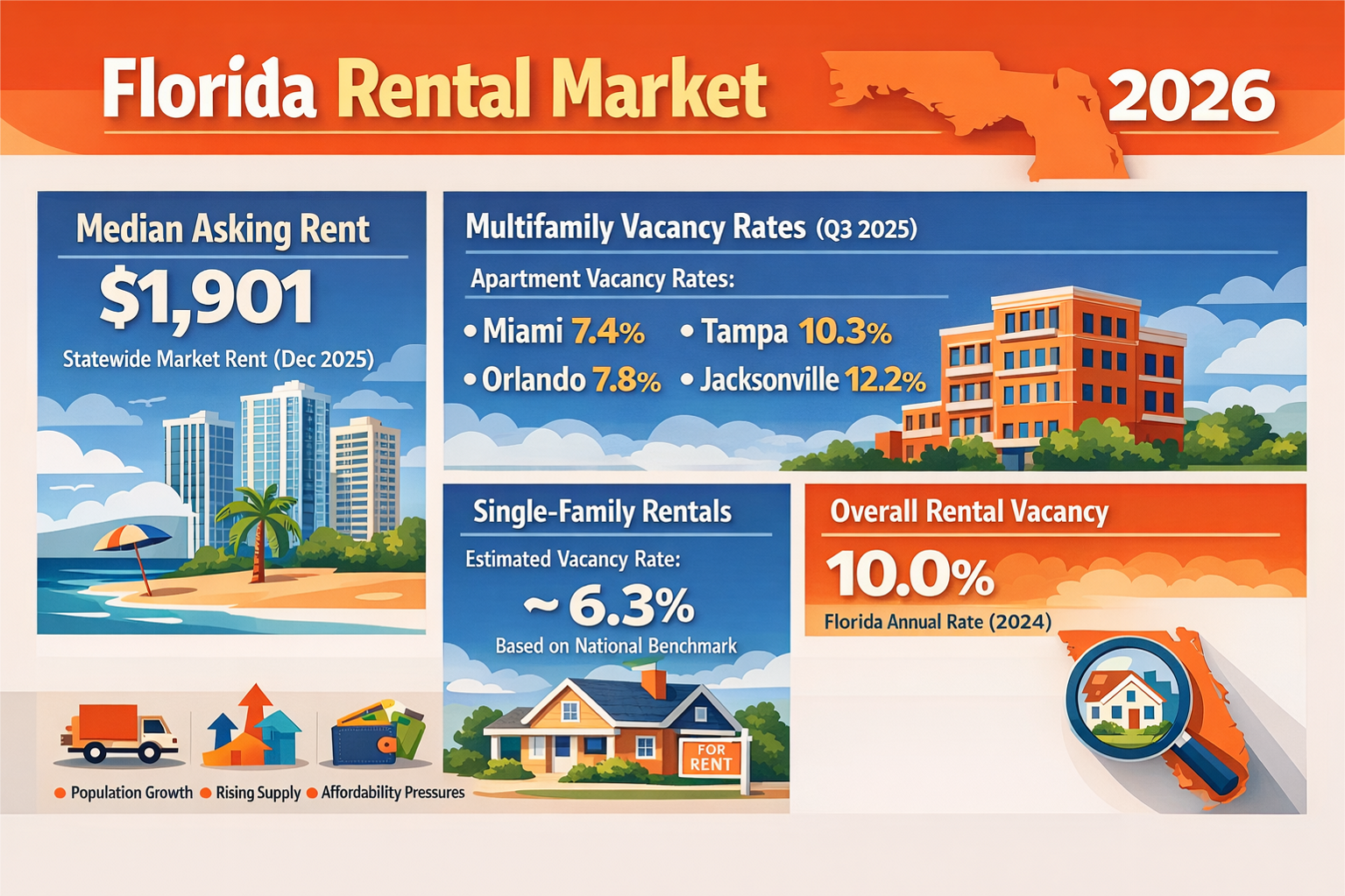

Florida landlords know that buying a rental property is a calculated move, unlike emotional homebuyers who pay 8-12% premiums for “feel-good” features in 2025’s $435,000 median home market. With rental property prices averaging $400,000 and costs rising, tax rules on depreciation can boost your cash flow significantly. By leveraging standard depreciation, bonus depreciation, and Section 179 deductions, you can lower taxes and keep more cash for reinvestment. Here’s how to make it work in Florida’s competitive rental market (6.5% vacancy rate).

What Is Depreciation and Why Does It Matter?

Depreciation is a tax deduction that lets you spread the cost of your rental property over its “useful life,” reducing taxable income without out-of-pocket costs. For a $400,000 duplex, this can mean thousands in annual tax savings, offsetting expenses like maintenance or debt. In 2025, three key depreciation strategies can supercharge your cash flow.

Key Depreciation Rules for 2025

- Standard Depreciation:

- How It Works: Deduct the building’s cost (not land) over 27.5 years using the straight-line method. For a $400,000 property with 20% land ($80,000), the depreciable basis is $320,000, yielding $11,636/year ($320,000 ÷ 27.5).

- Cash Flow: At a 25% tax rate, this saves $2,909 annually.

- Bonus Depreciation:

- How It Works: Deduct 20% of the cost of qualified improvements (e.g., new flooring, appliances) in year one. For a $30,000 renovation, that’s $6,000 upfront.

- Cash Flow: Saves $1,500 in taxes in 2025, ideal for post-purchase upgrades.

- Section 179 Deduction:

- How It Works: Deduct up to $1.22 million for personal property (e.g., appliances, furniture) or certain improvements (e.g., HVAC, fire alarms) in the year of purchase, if actively managing your rentals. For example, deduct $20,000 for new refrigerators in year one instead of over 5 years.

- Cash Flow: Saves $5,000 in taxes at 25%, but ensure the property is “in service” (rent-ready) and you meet active management rules.

- Cost Segregation (Advanced): Reclassify assets (e.g., carpets) as 5- or 7-year property for faster deductions. A $400,000 property might yield $60,000-$80,000 in year-one deductions, saving $15,000-$20,000 in taxes.

- Beware of Depreciation Recapture

- When selling, the IRS taxes total depreciation claimed at 25% (depreciation recapture). For $100,000 in deductions, you’d owe $25,000 upon sale. Defer this with a 1031 exchange, swapping one rental for another—30% of Florida landlords used this in 2024, per NAR.

How to Maximize Depreciation

- Get an Appraisal ($500-$1,000): Allocate purchase price accurately (e.g., 80% building, 20% land) to maximize the depreciable basis.

- Use Section 179 Wisely: Deduct qualifying purchases (e.g., $20,000 in appliances) if actively managing. Confirm eligibility with a CPA, as passive investors may be limited.

- Consider Cost Segregation ($5,000-$15,000): For properties over $500,000, accelerate deductions with a specialist’s study.

- Track Improvements: Log capital expenses (e.g., $10,000 AC unit) in QuickBooks ($30/month) for accurate depreciation.

- Hire a CPA ($1,000-$3,000/year): Ensure compliance and explore 1031 exchanges or “real estate professional” status for extra deductions.

Actionable Example

You buy a $450,000 Orlando triplex in June 2025, with $360,000 as the building basis and $30,000 in new appliances. Your deductions:

- Standard: $13,091/year ($360,000 ÷ 27.5).

- Section 179: $20,000 for appliances (if qualifying).

- Bonus: $2,000 (20% of remaining $10,000 renovation).

- Total Year-One: $35,091, saving $8,773 at 25% tax rate—cash for upgrades or debt.

Why This Matters

Depreciation offsets high purchase prices and rising costs (e.g., 15% tax hikes in 2025), letting you compete with tenants’ emotional demands for modern rentals. Unlike homebuyers, your economic focus maximizes returns.

Start Now

By July 2025, consult a CPA to plan depreciation, especially Section 179 for new purchases.

More on this subject from tax attorney and real estate investor, Toby Mathis

- What is the Difference Between Bonus & 179 Depreciation?

- How The Wealthy Use Depreciation to Reduce Taxes

- #1 Tax Loophole For Real Estate Investors (The Magic Of Cost Segregation!)

* Grok contributed to this article