Supercharge Cash Flow with Cost Segregation in 2025

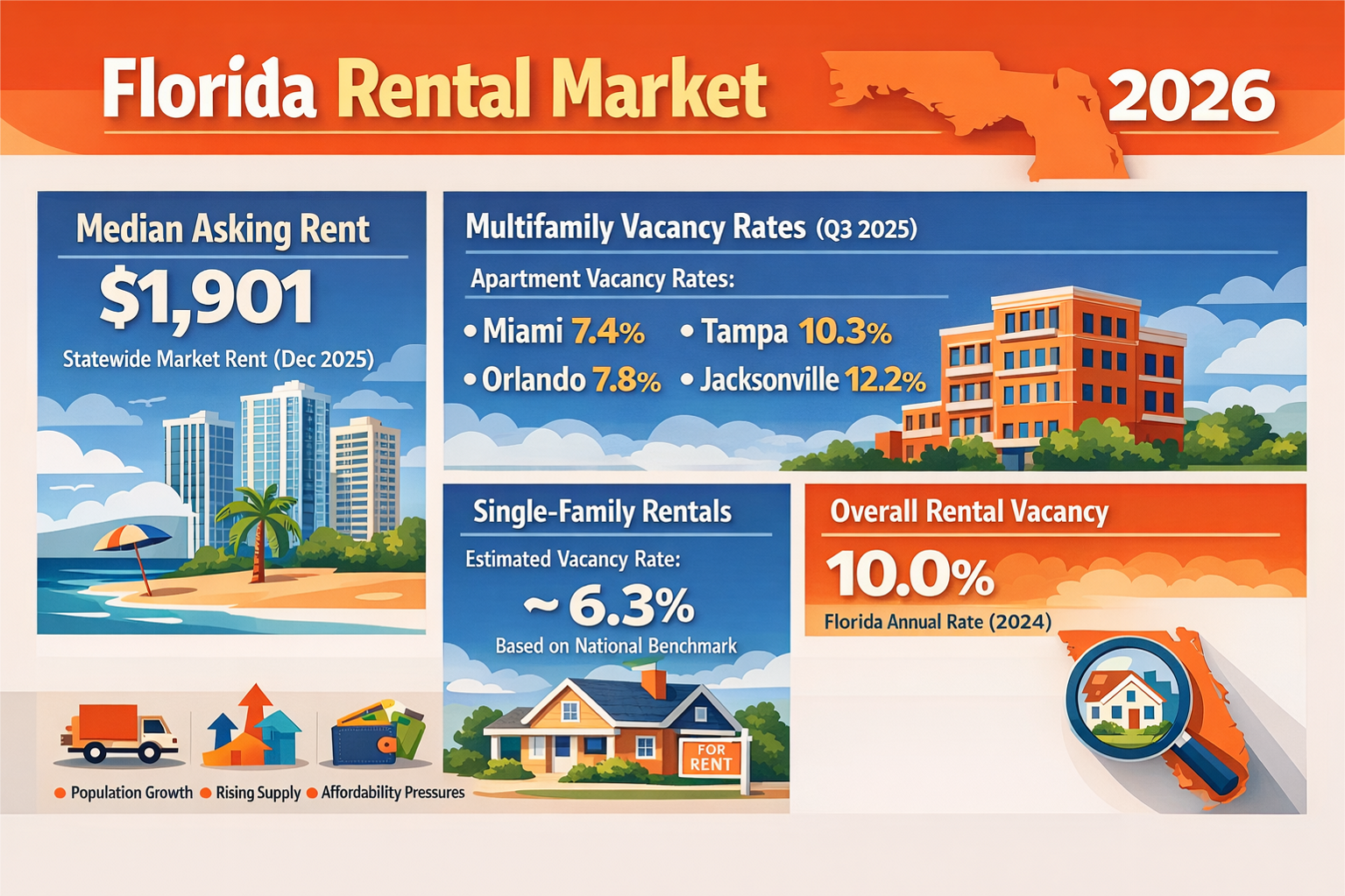

Florida landlords approach rental property purchases with economic precision, unlike homebuyers who pay 8-12% premiums for “feel-good” features in 2025’s $435,000 median home market. With rental properties averaging $400,000 and costs like property taxes up 15%, cost segregation is a game-changing tax strategy to boost cash flow. By accelerating depreciation deductions, cost segregation puts thousands of dollars back in your pocket upfront, perfect for reinvesting in Florida’s competitive rental market (6.5% vacancy rate). Here’s how it works and how to make it pay off.

What Is Cost Segregation?

Cost segregation is an IRS-approved tax strategy that lets you reclassify parts of your rental property as shorter-life assets, accelerating depreciation deductions. Instead of depreciating the entire building over 27.5 years (standard for residential rentals), you identify components like carpets, lighting, or HVAC systems as 5-, 7-, or 15-year property. This front-loads deductions, slashing taxable income in the first few years after purchase.

For example, a $400,000 property might yield $60,000-$80,000 in year-one deductions with cost segregation, compared to $11,636 with standard depreciation. At a 25% tax rate, that’s $15,000-$20,000 in tax savings—cash for upgrades, debt payments, or new acquisitions.

Why Cost Segregation Matters in 2025

- Immediate Cash Flow: Florida landlords face rising expenses (e.g., 15-25% insurance premium hikes). Cost segregation delivers big tax savings early, offsetting purchase costs or tenant-demanded improvements like modern kitchens.

- Market Advantage: Tenants prioritize emotionally appealing rentals. Use tax savings to fund upgrades, justifying 3-5% rent increases while staying competitive.

- Complements Other Strategies: Pair with Section 179 (up to $1.22 million for appliances) or bonus depreciation (20% for improvements) for even greater deductions, as allowed under 2025 IRS rules.

Key Rules and Considerations

- Eligible Properties: Residential rentals (e.g., duplexes, apartments) purchased or improved in 2025 qualify. The property must be “placed in service” (rent-ready).

- Study Required: A cost segregation study, conducted by a specialist, identifies and reclassifies assets. Costs range from $5,000-$15,000, depending on property size.

- Recapture Risk: Accelerated deductions are subject to 25% depreciation recapture upon sale. Defer this with a 1031 exchange, a strategy 30% of Florida landlords used in 2024, per NAR, to swap properties tax-free.

- Best for High-Value Properties: Cost segregation shines for properties over $500,000 or multi-unit buildings, where savings outweigh study costs.

How to Implement Cost Segregation

- Hire a Specialist ($5,000-$15,000): Engage a cost segregation firm (e.g., KBKG, CSSI) to conduct a detailed study, ensuring IRS compliance. Verify their experience with Florida rentals.

- Get an Appraisal ($500-$1,000): Confirm the property’s building vs. land value (e.g., 80% building, 20% land) to maximize the depreciable basis.

- Track Assets: Log reclassified components (e.g., $20,000 in lighting) in QuickBooks ($30/month) for accurate tax reporting.

- Consult a CPA ($1,000-$3,000/year): Ensure the study aligns with your tax strategy, including Section 179 or 1031 exchanges. File deductions on IRS Form 4562.

- Plan for Sale: Discuss 1031 exchange options with your CPA to defer recapture taxes, preserving long-term wealth.

Real-World Example

You buy a $600,000 Orlando apartment building in June 2025, with $480,000 as the building basis. A $10,000 cost segregation study reclassifies $120,000 as 5-year property and $50,000 as 15-year property. Year-one deductions:

- Cost Segregation: $40,000 (5- and 15-year assets) + $12,364 (remaining basis ÷ 27.5) = $52,364.

- Tax Savings: $13,091 at 25% tax rate—cash for tenant upgrades or debt.

Why It’s a Landlord’s Edge

Cost segregation aligns with your economic focus, offsetting high purchase prices and rising costs. Unlike emotional homebuyers, you can use these savings to meet tenants’ demands for modern rentals, boosting cash flow and returns.

* Grok contributed to this article