Strategies for Landlords in 2025

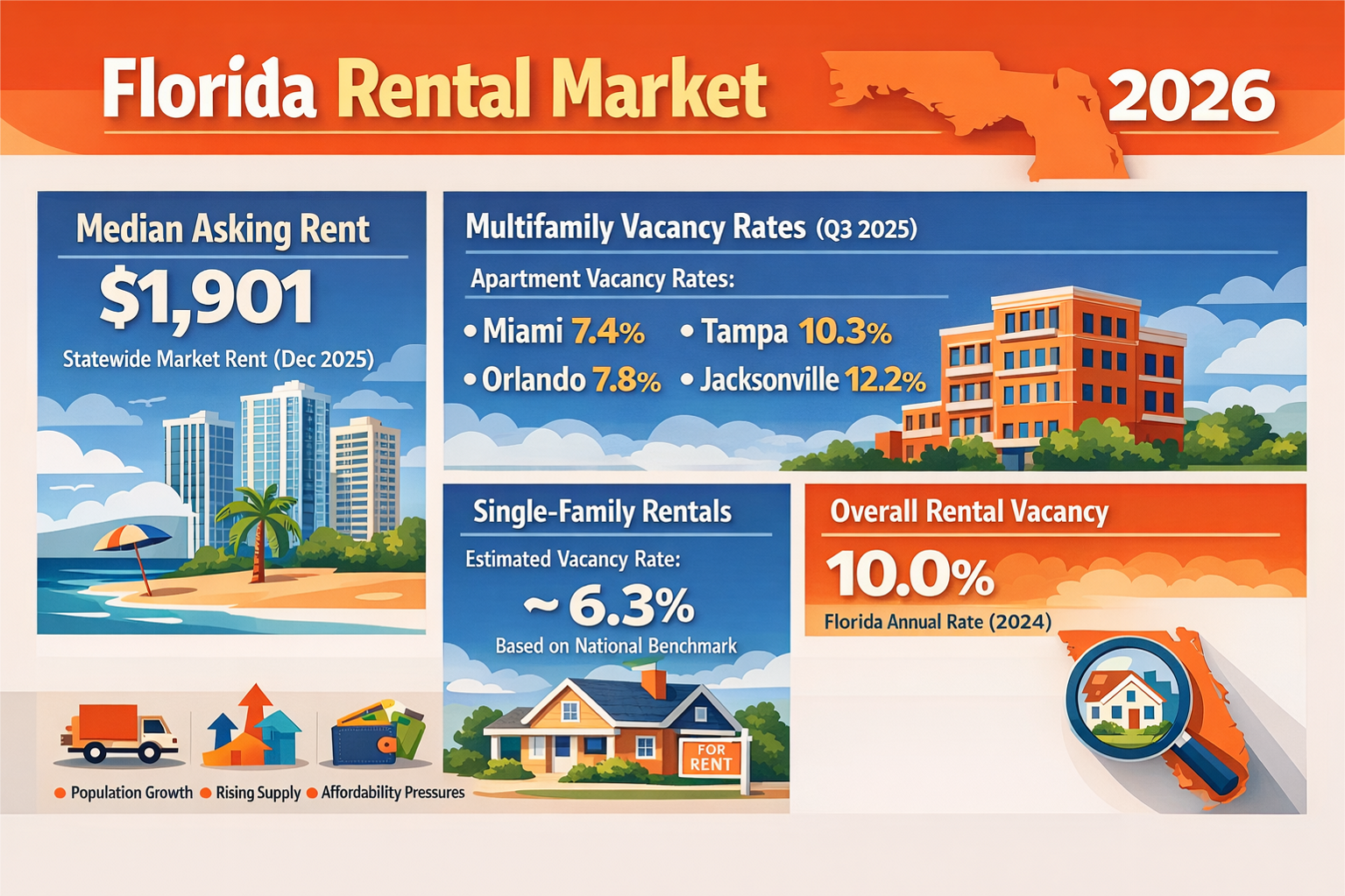

Florida landlords approach rental property purchases with economic precision, unlike homebuyers who pay 8-12% premiums for “feel-good” features in 2025’s $435,000 median home market. With rental properties averaging $400,000, skyrocketing insurance costs threaten profitability. In 2025, Florida’s home insurance premiums average $5,376 annually for $300,000 in coverage—over double the national average of $2,181—driven by hurricanes, inflation, litigation, and attorney fees. For landlords in a tight rental market (6.5% vacancy rate), managing these costs is crucial. Here’s why rates are climbing and how to protect your cash flow.

Why Insurance Costs Are Skyrocketing

- Frequent Hurricanes: Storms like Helene and Milton (2024) caused over $200 billion in damages, prompting insurers to raise premiums by 15-25% to cover claims. Florida’s 1,350-mile coastline, especially in Miami-Dade, amplifies risk.

- Inflation and Rebuild Costs: Construction materials and labor costs rose 5-7% in 2025, per JLL’s Construction Outlook, increasing replacement costs by 55% since 2020, forcing higher premiums.

- Outrageous Attorney Fees: Florida’s litigation-heavy insurance market, driven by excessive attorney fees, accounts for 70% of U.S. property insurance lawsuits. Lawyers often exploit “assignment of benefits” or bad-faith claims, inflating costs by 20-30% for insurers, who pass these to landlords.

- Market Instability: Since 2022, 12 insurers exited Florida or went insolvent, reducing competition. Citizens Property Insurance, covering 1.4 million policies, charges higher rates for less coverage.

- Fraud: Inflated claims, like unnecessary roof replacements, persist despite reforms like SB 2A (2022), adding to premium hikes.

Impact on Landlords

Premiums, up 31% since 2022, erode cash flow, forcing landlords to absorb costs, raise rents (risking turnover), or cut maintenance. Unlike emotional homebuyers, landlords must balance 5-7% cap rates with tenants’ demands for modern rentals, making cost control essential.

How to Manage Rising Insurance Costs

- Shop Around Annually ($0-$200): Compare quotes from private insurers and Citizens via Policygenius. Seek wind mitigation discounts, which cut rates for 75% of Miami-Dade policyholders in 2025.

- Invest in Mitigation Upgrades ($2,000-$10,000): Install impact windows or hurricane shutters to reduce premiums by 10-20%. A windstorm mitigation inspection ($150-$300) identifies credits.

- Raise Deductibles ($0): Choose a $5,000 deductible over $1,000 to lower premiums, saving 15% for Tampa landlords in 2024, but maintain cash reserves for claims.

- Bundle Policies ($0): Combine home and auto insurance with one carrier (e.g., Progressive) for 5-10% discounts, despite limited carrier options.

- Hire an Insurance Broker ($500-$1,000): A broker can secure better rates for multi-unit properties, where rent-to-insurance ratios hit 40% in some areas.

Real-World Example

You own a $500,000 Clearwater triplex with a $6,000 premium in 2025. Adding $5,000 in shutters and raising the deductible to $5,000 cuts the premium to $4,800 (20% savings). Bundling auto insurance saves $240. Total savings: $1,440—cash for tenant upgrades or debt.

Why It’s Critical

With premiums projected to reach $11,759 by late 2025, rising costs threaten your economic edge. Savings can fund modern rentals, meeting tenants’ emotional demands while preserving 4.5% rental yields.

* Grok contributed to this article