Florida’s Rental Market in 2026

Rents, Vacancies, and What’s Driving the Shift

Florida’s rental market has entered 2026 in a noticeably different posture than the peak “pandemic boom” years. After a period of rapid rent gains and razor-thin availability, many parts of the state are now in a normalization phase: demand is still strong (Florida remains a high-migration state), but a wave of new supply and slower household formation has eased pricing pressure in many metros. For renters, that can mean more choices and modest negotiating leverage. For landlords and investors, it means sharper competition, more emphasis on property condition and marketing, and a closer watch on vacancy.

Below is a statewide snapshot focused on three core questions: What is the typical (median/market) asking rent? What are vacancy conditions in multifamily? And what do we know about vacancy conditions for single-family rentals?

Median asking rent:

What does it cost to rent in Florida?

There is no single rent figure that fully captures Florida’s diverse rental market. Conditions vary widely between South Florida, Central Florida, the Panhandle, and inland regions, as well as between urban high-rise apartments and suburban single-family homes. Still, widely used rent indices help establish a reliable statewide benchmark.

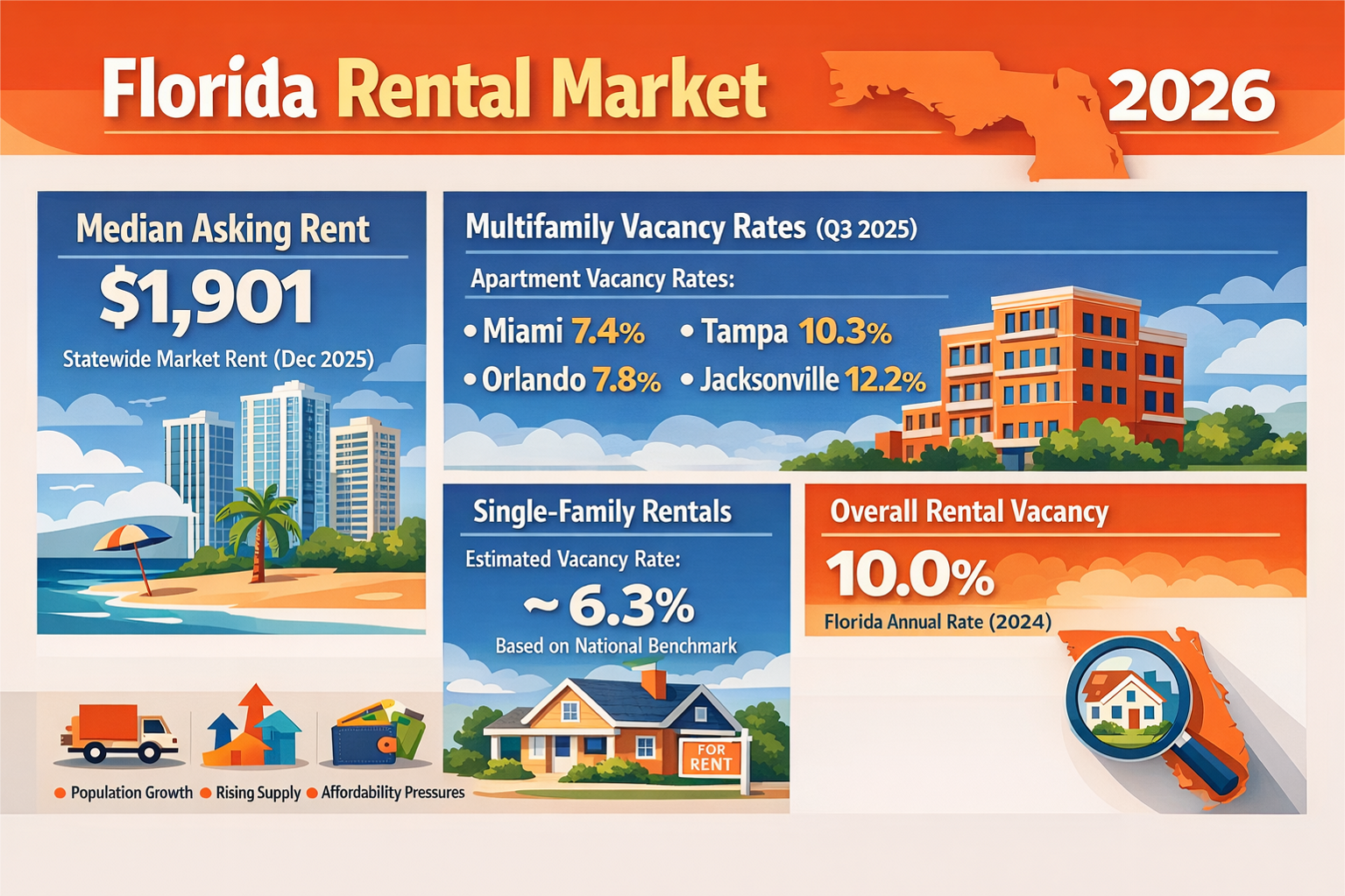

One commonly cited measure is the Zillow Observed Rent Index (ZORI), which tracks typical market rents while adjusting for changes in the mix of available units. As of late 2025, Florida’s typical market rent measured by this index stood at approximately $1,901 per month.

This figure should be understood as a statewide reference point rather than a precise “median asking rent” for every neighborhood. Coastal and high-growth metros—such as Miami-Fort Lauderdale, Naples, and parts of Tampa Bay—often exceed this level, while many smaller and inland markets fall below it.

To understand the impact on households, it is also useful to look at rents actually being paid. Data from the University of Florida’s Shimberg Center for Housing Studies shows that Florida’s median gross rent (rent plus utilities) increased from $1,238 in 2019 to $1,719 in 2023, a rise of roughly 39 percent in just four years. While gross rent is not the same as asking rent, it highlights the significant affordability pressure Florida renters continue to face.

Bottom line: Rents remain elevated compared with pre-2020 levels, but the story entering 2026 is less about rapid increases and more about stabilization, segmentation, and heightened competition—especially in areas with recent apartment deliveries.

Multifamily vacancy

Are apartments easier to find?

The defining feature of Florida’s multifamily market in 2025 and early 2026 has been new supply. Large numbers of apartment units delivered across major metros have outpaced near-term demand in several areas, pushing vacancy rates higher and slowing rent growth.

Examples from major Florida markets in Q3 2025 illustrate this trend:

- Miami: Multifamily vacancy rose to roughly 7.4 percent, reflecting increased availability following a wave of new construction.

- Orlando: Occupancy around 92.2 percent, implying a vacancy rate near 7.8 percent.

- Tampa: Vacancy reached approximately 10.3 percent, signaling a more competitive leasing environment.

- Jacksonville: Vacancy climbed higher, to about 12.2 percent, as new deliveries exceeded absorption.

These figures underscore an important point: Florida does not have a single multifamily market. Vacancy conditions vary significantly by metro, submarket, and property class. Newer, higher-priced properties often feel the pressure first, while well-located workforce housing may remain relatively tight.

Higher multifamily vacancy typically results in:

- Increased concessions and move-in incentives

- Longer lease-up times

- Greater emphasis on unit condition, amenities, and marketing

- Slower rent growth, and in some pockets, modest rent declines

Single-family rentals

A different dynamic

Single-family rentals operate under a different set of dynamics than apartments. Tenants are often families seeking more space, school proximity, and longer-term stability. Supply is also more constrained, particularly because many homeowners remain locked into low mortgage rates and are reluctant to sell.

One challenge in analyzing this segment is data availability: Florida-specific single-family rental vacancy rates are not consistently published as a standalone metric. However, two reference points help frame the discussion.

First, Florida’s overall rental vacancy rate—which includes apartments, small multifamily properties, and single-family rentals—was approximately 10.0 percent in 2024, according to Census-based estimates. This provides a broad statewide availability indicator but does not isolate single-family homes.

Second, at the national level, single-family rental vacancy rates have been reported in the range of 6 percent to 6.5 percent during 2024–2025. While Florida’s exact figure may differ, this suggests that single-family rentals generally remain tighter than many apartment markets.

Practical takeaway: Even as apartment vacancy rises in some Florida metros, well-located single-family rentals—especially in desirable school zones and suburban commuter areas—can remain comparatively resilient. That said, they are not immune to affordability constraints and increased competition from concessions in the multifamily sector.

What’s driving Florida’s rental market?

Several forces are shaping current conditions:

- New supply: Apartment deliveries have outpaced short-term demand in several metros, lifting vacancy.

- Affordability constraints: Rapid rent growth earlier in the decade continues to strain household budgets.

- Migration and job growth: In-migration remains a long-term demand driver, but not always enough to absorb new supply immediately.

- Operating costs: Insurance, taxes, and maintenance costs influence landlord pricing decisions and investment behavior.

Outlook for 2026

As Florida moves through 2026, the rental market is likely to reward disciplined pricing, responsive management, and property differentiation. Landlords may need to adjust rents more frequently, emphasize unit readiness, and use concessions strategically. Renters, meanwhile, may find improved availability and better negotiating leverage than during the peak years of 2021–2022.

Quick summary

- Typical market rent: About $1,900 per month statewide

- Multifamily vacancy: Ranges roughly from 7 percent to 12 percent, depending on metro

- Overall rental vacancy (Florida): About 10 percent

- Single-family rentals: Generally tighter than apartments, but showing modest softening