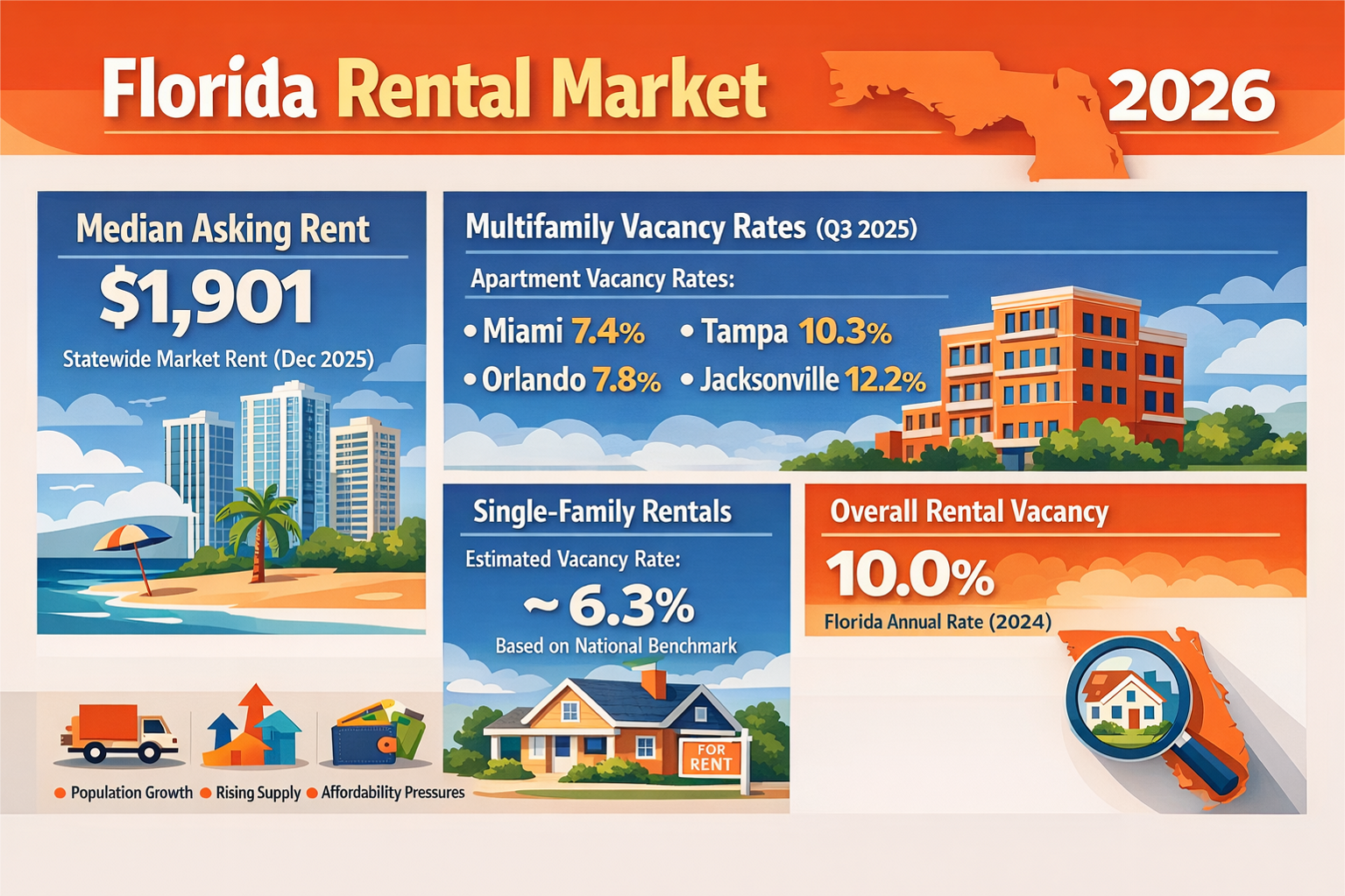

For years, Florida landlords have been divided on whether accepting Section 8 housing vouchers—officially known as the Housing Choice Voucher (HCV) Program—is a smart business move. But as the rental market softens in many metros and affordability pressures rise, more owners are taking a fresh look at the program.

Here’s an updated, Florida-specific analysis to help landlords decide whether Section 8 tenants are a good fit in 2025.

The Benefits:

Why Florida Landlords Are Reconsidering Section 8

✔ Guaranteed Rent (Mostly)

Housing Authorities pay their portion of the rent directly to the landlord, on time, every month. This has become even more attractive as tenant delinquencies have risen statewide due to inflation and debt burdens.

✔ Strong Demand in Many Counties

As of 2025:

- Miami-Dade, Broward, and Palm Beach have long voucher waitlists.

- Jacksonville, Tampa, and Orlando report voucher holders struggling to find units.

- Rural counties often have outdated housing stock, giving private landlords a competitive edge.

In many regions, voucher tenants are actively searching for units—and willing to sign longer lease terms to secure them.

✔ Local Incentives Are Growing

To encourage landlord participation, some Florida Housing Authorities now offer:

- Sign-on bonuses (often $300–$1,000 per unit)

- Damage mitigation funds (covering damage beyond deposit amounts)

- Faster reinspection windows

- Vacancy loss payments if the tenant moves out unexpectedly.

Programs vary by county, but these incentives can significantly improve ROI.

The Downsides:

What Florida Landlords Dislike About Section 8

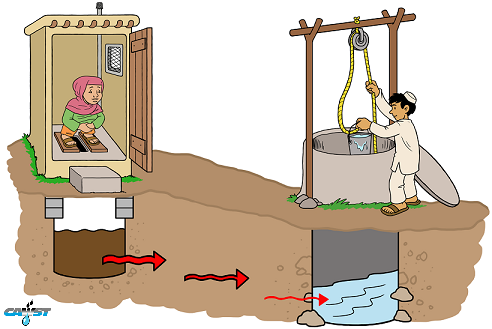

✘ Inspections Can Be Slow or Inconsistent

The required Housing Quality Standards (HQS) inspection is the #1 complaint. Failures for minor issues—such as missing outlet covers or loose handrails—can delay move-ins and rent payments.

Some Housing Authorities are improving turnaround times, but others still suffer from backlogs.

✘ Rent Caps May Limit Profitability

Each county has a Payment Standard based on HUD’s Fair Market Rents. In areas where market rents have risen faster than HUD adjustments, landlords may not be able to charge top-of-market rates. This is more problematic in high-demand counties like Miami-Dade and Monroe, and less of an issue in affordable counties like Polk or Escambia.

✘ Dealing With Tenant Behavior Issues

Voucher tenants must comply with program rules, but:

- Evictions still follow standard Florida procedure.

- Some Housing Authorities may be slow to terminate assistance for noncompliance; but this does not prevent a landlord from evicting for failure to cure non-compliance.

- Poor housekeeping or higher wear-and-tear can increase turnover costs.

The Financial Reality:

Section 8 Can Outperform Market Rent

In certain ZIP codes, especially in mid-tier neighborhoods, Section 8 payment standards

exceed what many tenants can afford normally. This makes voucher tenants highly competitive and reduces vacancy time.

Section 8 often works best where:

- Properties are in B or C-grade neighborhoods

- Competition with new Class-A apartments is irrelevant

- Turnover tends to be low

- Landlords want predictable cash flow

For higher-end homes or neighborhoods with rapidly appreciating rents, however, the payment standards may fall short.

4. Verdict: Is It “Worth It”?

Section 8 is not a one-size-fits-all solution. But in 2025 Florida’s environment makes it increasingly attractive for:

- Cash-flow investors

- Landlords with multiple mid-tier units

- Owners needing rent certainty

- Long-distance landlords who want stable tenants

- Properties where market rent is close to HUD standards